Introduction to Regression with statsmodels in Python

# Importing pandas

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

# Importing the course arrays

conversion = pd.read_csv("datasets/ad_conversion.csv")

churn = pd.read_csv("datasets/churn.csv")

fish = pd.read_csv("datasets/fish.csv")

sp500 = pd.read_csv("datasets/sp500_yearly_returns.csv")

taiwan = pd.read_csv("datasets/taiwan_real_estate2.csv")Chapter 1: Simple Linear Regression Modeling

You’ll learn the basics of this popular statistical model, what regression is, and how linear and logistic regressions differ. You’ll then learn how to fit simple linear regression models with numeric and categorical explanatory variables, and how to describe the relationship between the response and explanatory variables using model coefficients.

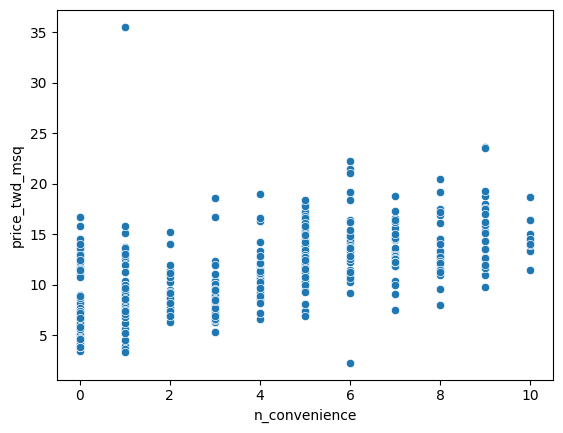

Visualizing two numeric variables

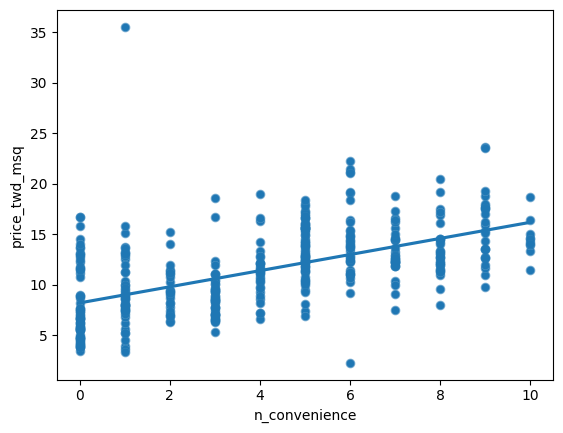

Before you can run any statistical models, it’s usually a good idea to visualize your dataset. Here, you’ll look at the relationship between house price per area and the number of nearby convenience stores using the Taiwan real estate dataset.

One challenge in this dataset is that the number of convenience stores contains integer data, causing points to overlap. To solve this, you will make the points transparent.

taiwan_real_estate is available as a pandas DataFrame. ### Instructions - Import the seaborn package, aliased as sns. - Using taiwan_real_estate, draw a scatter plot of “price_twd_msq” (y-axis) versus “n_convenience” (x-axis). - Draw a trend line calculated using linear regression. Omit the confidence interval ribbon. Note: The scatter_kws argument, pre-filled in the exercise, makes the data points 50% transparent.

taiwan_real_estate=taiwan

# Import seaborn with alias sns

import seaborn as sns

# Import matplotlib.pyplot with alias plt

import matplotlib.pyplot as plt

# Draw the scatter plot

sns.scatterplot(x="n_convenience",y="price_twd_msq", data=taiwan_real_estate)

# Show the plot

plt.show()

# Import seaborn with alias sns

import seaborn as sns

# Import matplotlib.pyplot with alias plt

import matplotlib.pyplot as plt

# Draw the scatter plot

sns.scatterplot(x="n_convenience",

y="price_twd_msq",

data=taiwan_real_estate)

# Draw a trend line on the scatter plot of price_twd_msq vs. n_convenience

sns.regplot(x='n_convenience',

y='price_twd_msq',

data=taiwan_real_estate,

ci=None,

scatter_kws={'alpha': 0.5})

# Show the plot

plt.show()

Linear regression with ols()

While sns.regplot() can display a linear regression trend line, it doesn’t give you access to the intercept and slope as variables, or allow you to work with the model results as variables. That means that sometimes you’ll need to run a linear regression yourself.

Time to run your first model!

taiwan_real_estate is available. TWD is an abbreviation for Taiwan dollars.

In addition, for this exercise and the remainder of the course, the following packages will be imported and aliased if necessary: matplotlib.pyplot as plt, seaborn as sns, and pandas as pd. ### Instructions - Import the ols() function from the statsmodels.formula.api package. - Run a linear regression with price_twd_msq as the response variable, n_convenience as the explanatory variable, and taiwan_real_estate as the dataset. Name it mdl_price_vs_conv. - Fit the model. - Print the parameters of the fitted model.

# Import the ols function

from statsmodels.formula.api import ols

# Create the model object

mdl_price_vs_conv = ols("price_twd_msq~n_convenience", data=taiwan_real_estate)

# Fit the model

mdl_price_vs_conv = mdl_price_vs_conv.fit()

# Print the parameters of the fitted model

print(mdl_price_vs_conv.params)Intercept 8.224237

n_convenience 0.798080

dtype: float64Question

The model had an Intercept coefficient of 8.2242. What does this mean?Answer

On average, a house with zero convenience stores nearby had a price of 8.2242 TWD per square meterQuestion

The model had an n_convenience coefficient of 0.7981. What does this mean?Answer

If you increase the number of nearby convenience stores by one, then the expected increase in house price is 0.7981 TWD per square meterVisualizing numeric vs. categorical

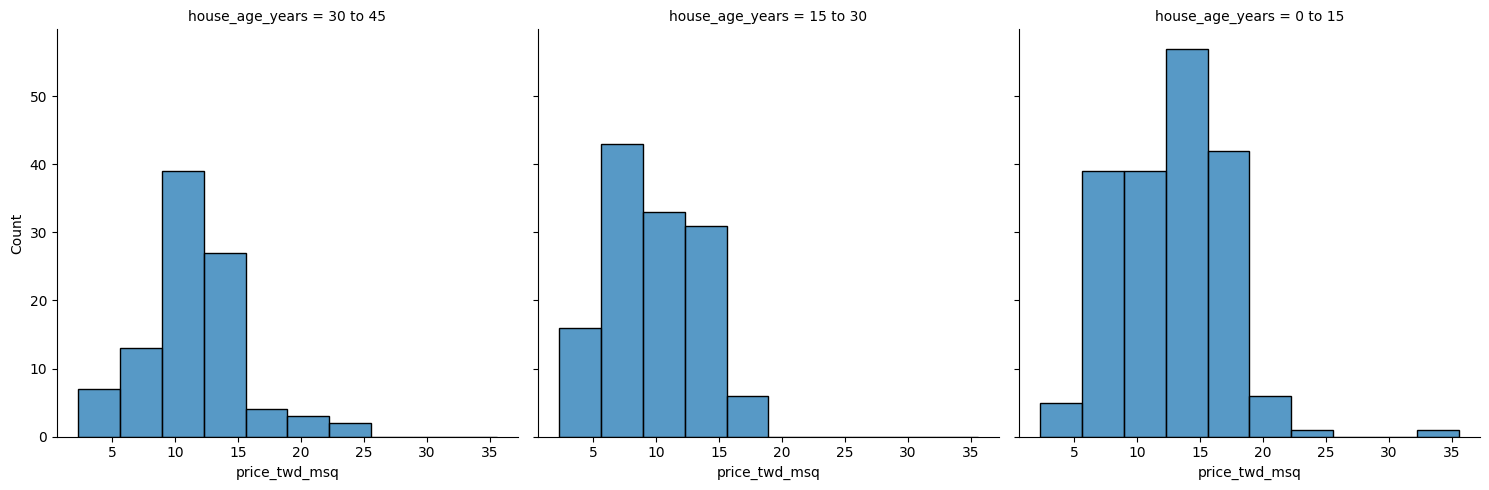

If the explanatory variable is categorical, the scatter plot that you used before to visualize the data doesn’t make sense. Instead, a good option is to draw a histogram for each category.

The Taiwan real estate dataset has a categorical variable in the form of the age of each house. The ages have been split into 3 groups: 0 to 15 years, 15 to 30 years, and 30 to 45 years.

taiwan_real_estate is available. ### Instructions - Using taiwan_real_estate, plot a histogram of price_twd_msq with 10 bins. Split the plot by house_age_years to give 3 panels.

# Histograms of price_twd_msq with 10 bins, split by the age of each house

sns.displot(data=taiwan_real_estate,

x='price_twd_msq',

col='house_age_years',

col_wrap=3,

bins=10)

# Show the plot

plt.show()

Calculating means by category

A good way to explore categorical variables further is to calculate summary statistics for each category. For example, you can calculate the mean and median of your response variable, grouped by a categorical variable. As such, you can compare each category in more detail.

Here, you’ll look at grouped means for the house prices in the Taiwan real estate dataset. This will help you understand the output of a linear regression with a categorical variable.

taiwan_real_estate is available as a pandas DataFrame. ### Instructions - Group taiwan_real_estate by house_age_years and calculate the mean price (price_twd_msq) for each age group. Assign the result to mean_price_by_age. - Print the result and inspect the output.

# Calculate the mean of price_twd_msq, grouped by house age

mean_price_by_age = taiwan_real_estate.groupby('house_age_years')['price_twd_msq'].mean()

# Print the result

print(mean_price_by_age)house_age_years

0 to 15 12.637471

15 to 30 9.876743

30 to 45 11.393264

Name: price_twd_msq, dtype: float64Linear regression with a categorical explanatory variable

Great job calculating those grouped means! As mentioned in the last video, the means of each category will also be the coefficients of a linear regression model with one categorical variable. You’ll prove that in this exercise.

To run a linear regression model with categorical explanatory variables, you can use the same code as with numeric explanatory variables. The coefficients returned by the model are different, however. Here you’ll run a linear regression on the Taiwan real estate dataset.

taiwan_real_estate is available and the ols() function is also loaded. ### Instructions - Run and fit a linear regression with price_twd_msq as the response variable, house_age_years as the explanatory variable, and taiwan_real_estate as the dataset. Assign to mdl_price_vs_age. - Print its parameters. - Update the model formula so that no intercept is included in the model. Assign to mdl_price_vs_age0. - Print its parameters.

# Create the model, fit it

mdl_price_vs_age = ols("price_twd_msq~house_age_years", data=taiwan_real_estate).fit()

# Print the parameters of the fitted model

print(mdl_price_vs_age.params)

# Update the model formula to remove the intercept

mdl_price_vs_age0 = ols("price_twd_msq ~ house_age_years+0", data=taiwan_real_estate).fit()

# Print the parameters of the fitted model

print(mdl_price_vs_age0.params)Intercept 12.637471

house_age_years[T.15 to 30] -2.760728

house_age_years[T.30 to 45] -1.244207

dtype: float64

house_age_years[0 to 15] 12.637471

house_age_years[15 to 30] 9.876743

house_age_years[30 to 45] 11.393264

dtype: float64Chapter 2: Predictions and model objects

In this chapter, you’ll discover how to use linear regression models to make predictions on Taiwanese house prices and Facebook advert clicks. You’ll also grow your regression skills as you get hands-on with model objects, understand the concept of “regression to the mean”, and learn how to transform variables in a dataset.

Predicting house prices

Perhaps the most useful feature of statistical models like linear regression is that you can make predictions. That is, you specify values for each of the explanatory variables, feed them to the model, and get a prediction for the corresponding response variable. The code flow is as follows.

explanatory_data = pd.DataFrame({“explanatory_var”: list_of_values}) predictions = model.predict(explanatory_data) prediction_data = explanatory_data.assign(response_var=predictions)

Here, you’ll make predictions for the house prices in the Taiwan real estate dataset.

taiwan_real_estate is available. The fitted linear regression model of house price versus number of convenience stores is available as mdl_price_vs_conv. For future exercises, when a model is available, it will also be fitted. ### Instructions - Import the numpy package using the alias np. - Create a DataFrame of explanatory data, where the number of convenience stores, n_convenience, takes the integer values from zero to ten. - Print explanatory_data. - Use the model mdl_price_vs_conv to make predictions from explanatory_data and store it as price_twd_msq. - Print the predictions. - Create a DataFrame of predictions named prediction_data. Start with explanatory_data, then add an extra column, price_twd_msq, containing the predictions you created in the previous step.

# Import numpy with alias np

import numpy as np

# Create explanatory_data

explanatory_data = pd.DataFrame({'n_convenience': np.arange(0, 11)})

# Use mdl_price_vs_conv to predict with explanatory_data, call it price_twd_msq

price_twd_msq = mdl_price_vs_conv.predict(explanatory_data)

# Create prediction_data

prediction_data = explanatory_data.assign(

price_twd_msq = mdl_price_vs_conv.predict(explanatory_data))

# Print the result

print(prediction_data) n_convenience price_twd_msq

0 0 8.224237

1 1 9.022317

2 2 9.820397

3 3 10.618477

4 4 11.416556

5 5 12.214636

6 6 13.012716

7 7 13.810795

8 8 14.608875

9 9 15.406955

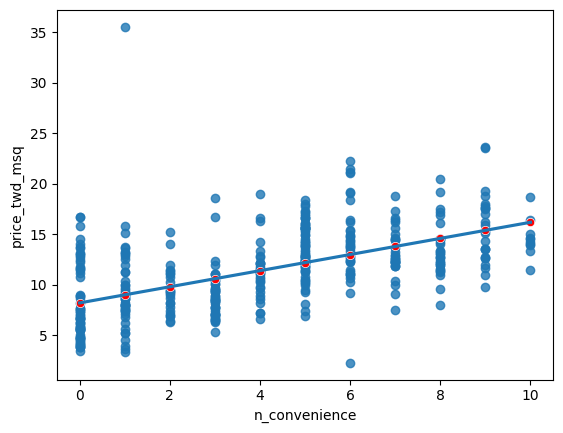

10 10 16.205035Visualizing predictions

The prediction DataFrame you created contains a column of explanatory variable values and a column of response variable values. That means you can plot it on the same scatter plot of response versus explanatory data values.

prediction_data is available. The code for the plot you created using sns.regplot() in Chapter 1 is shown. ### Instructions - Create a new figure to plot multiple layers. - Extend the plotting code to add points for the predictions in prediction_data. Color the points red. - Display the layered plot.

# Create a new figure, fig

fig = plt.figure()

sns.regplot(x="n_convenience",

y="price_twd_msq",

data=taiwan_real_estate,

ci=None)

# Add a scatter plot layer to the regplot

sns.scatterplot(x="n_convenience",

y="price_twd_msq",

data=prediction_data,

color = 'red')

# Show the layered plot

plt.show()

The limits of prediction

In the last exercise, you made predictions on some sensible, could-happen-in-real-life, situations. That is, the cases when the number of nearby convenience stores were between zero and ten. To test the limits of the model’s ability to predict, try some impossible situations.

Use the console to try predicting house prices from mdl_price_vs_conv when there are -1 convenience stores. Do the same for 2.5 convenience stores. What happens in each case?

mdl_price_vs_conv is available. ### Instructions - Create some impossible explanatory data. Define a DataFrame impossible with one column, n_convenience, set to -1 in the first row, and 2.5 in the second row.

Extracting model elements

The model object created by ols() contains many elements. In order to perform further analysis on the model results, you need to extract its useful bits. The model coefficients, the fitted values, and the residuals are perhaps the most important pieces of the linear model object.

mdl_price_vs_conv is available. ### Instructions - Print the parameters of mdl_price_vs_conv. - Print the fitted values of mdl_price_vs_conv. - Print the residuals of mdl_price_vs_conv. - Print a summary of mdl_price_vs_conv.

# Print the model parameters of mdl_price_vs_conv

print(mdl_price_vs_conv.params)

# Print the fitted values of mdl_price_vs_conv

print(mdl_price_vs_conv.fittedvalues)

# Print the residuals of mdl_price_vs_conv

print(mdl_price_vs_conv.resid)

# Print a summary of mdl_price_vs_conv

print(mdl_price_vs_conv.summary())Intercept 8.224237

n_convenience 0.798080

dtype: float64

0 16.205035

1 15.406955

2 12.214636

3 12.214636

4 12.214636

...

409 8.224237

410 15.406955

411 13.810795

412 12.214636

413 15.406955

Length: 414, dtype: float64

0 -4.737561

1 -2.638422

2 2.097013

3 4.366302

4 0.826211

...

409 -3.564631

410 -0.278362

411 -1.526378

412 3.670387

413 3.927387

Length: 414, dtype: float64

OLS Regression Results

==============================================================================

Dep. Variable: price_twd_msq R-squared: 0.326

Model: OLS Adj. R-squared: 0.324

Method: Least Squares F-statistic: 199.3

Date: Sat, 30 Dec 2023 Prob (F-statistic): 3.41e-37

Time: 08:49:14 Log-Likelihood: -1091.1

No. Observations: 414 AIC: 2186.

Df Residuals: 412 BIC: 2194.

Df Model: 1

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

Intercept 8.2242 0.285 28.857 0.000 7.664 8.784

n_convenience 0.7981 0.057 14.118 0.000 0.687 0.909

==============================================================================

Omnibus: 171.927 Durbin-Watson: 1.993

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1417.242

Skew: 1.553 Prob(JB): 1.78e-308

Kurtosis: 11.516 Cond. No. 8.87

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.Manually predicting house prices

You can manually calculate the predictions from the model coefficients. When making predictions in real life, it is better to use .predict(), but doing this manually is helpful to reassure yourself that predictions aren’t magic - they are simply arithmetic.

In fact, for a simple linear regression, the predicted value is just the intercept plus the slope times the explanatory variable.

mdl_price_vs_conv and explanatory_data are available. ### Instructions - Get the coefficients/parameters of mdl_price_vs_conv, assigning to coeffs. - Get the intercept, which is the first element of coeffs, assigning to intercept. - Get the slope, which is the second element of coeffs, assigning to slope. - Manually predict price_twd_msq using the formula, specifying the intercept, slope, and explanatory_data. - Run the code to compare your manually calculated predictions to the results from .predict().

# Get the coefficients of mdl_price_vs_conv

coeffs = mdl_price_vs_conv.params

# Get the intercept

intercept = coeffs[0]

# Get the slope

slope = coeffs[1]

# Manually calculate the predictions

price_twd_msq = intercept+explanatory_data*slope

print(price_twd_msq)

# Compare to the results from .predict()

print(price_twd_msq.assign(predictions_auto=mdl_price_vs_conv.predict(explanatory_data))) n_convenience

0 8.224237

1 9.022317

2 9.820397

3 10.618477

4 11.416556

5 12.214636

6 13.012716

7 13.810795

8 14.608875

9 15.406955

10 16.205035

n_convenience predictions_auto

0 8.224237 8.224237

1 9.022317 9.022317

2 9.820397 9.820397

3 10.618477 10.618477

4 11.416556 11.416556

5 12.214636 12.214636

6 13.012716 13.012716

7 13.810795 13.810795

8 14.608875 14.608875

9 15.406955 15.406955

10 16.205035 16.205035Plotting consecutive portfolio returns

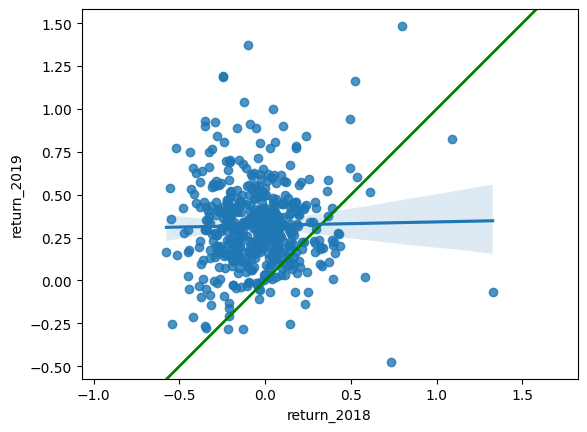

Regression to the mean is also an important concept in investing. Here you’ll look at the annual returns from investing in companies in the Standard and Poor 500 index (S&P 500), in 2018 and 2019.

The sp500_yearly_returns dataset contains three columns:

symbol Stock ticker symbol uniquely identifying the company.

return_2018 A measure of investment performance in 2018.

return_2019 A measure of investment performance in 2019.

A positive number for the return means the investment increased in value; negative means it lost value.

Just as with baseball home runs, a naive prediction might be that the investment performance stays the same from year to year, lying on the y equals x line.

sp500_yearly_returns is available as a pandas DataFrame. ### Instructions - Create a new figure, fig, to enable plot layering. - Generate a line at y equals x. This has been done for you. - Using sp500_yearly_returns, draw a scatter plot of return_2019 vs. return_2018 with a linear regression trend line, without a standard error ribbon. - Set the axes so that the distances along the x and y axes look the same.

sp500_yearly_returns = sp500

# Create a new figure, fig

fig = plt.figure()

# Plot the first layer: y = x

plt.axline(xy1=(0,0), slope=1, linewidth=2, color="green")

# Add scatter plot with linear regression trend line

sns.regplot(y='return_2019',x='return_2018',data=sp500_yearly_returns)

# Set the axes so that the distances along the x and y axes look the same

plt.axis("equal")

# Show the plot

plt.show()

Modeling consecutive returns

Let’s quantify the relationship between returns in 2019 and 2018 by running a linear regression and making predictions. By looking at companies with extremely high or extremely low returns in 2018, we can see if their performance was similar in 2019.

sp500_yearly_returns is available and ols() is loaded. ### Instructions - Run a linear regression on return_2019 versus return_2018 using sp500_yearly_returns and fit the model. Assign to mdl_returns. - Print the parameters of the model.

# Run a linear regression on return_2019 vs. return_2018 using sp500_yearly_returns

mdl_returns = ols("return_2019 ~ return_2018", data=sp500_yearly_returns).fit()

# Print the parameters

print(mdl_returns.params)Intercept 0.321321

return_2018 0.020069

dtype: float64mdl_returns = ols("return_2019 ~ return_2018", data=sp500_yearly_returns).fit()

# Create a DataFrame with return_2018 at -1, 0, and 1

explanatory_data = pd.DataFrame({"return_2018":[-1,0,1]})

# Use mdl_returns to predict with explanatory_data

print(mdl_returns.predict(explanatory_data))0 0.301251

1 0.321321

2 0.341390

dtype: float64Transforming the explanatory variable

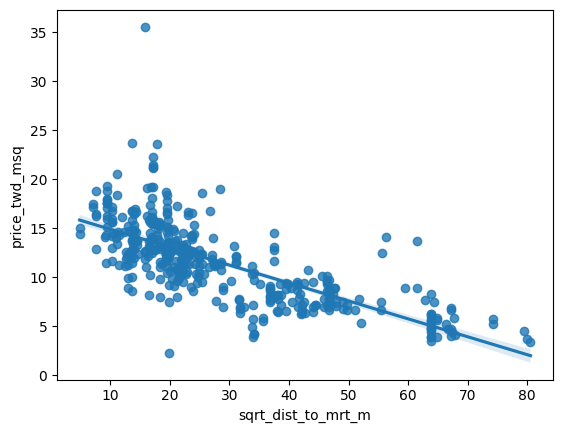

If there is no straight-line relationship between the response variable and the explanatory variable, it is sometimes possible to create one by transforming one or both of the variables. Here, you’ll look at transforming the explanatory variable.

You’ll take another look at the Taiwan real estate dataset, this time using the distance to the nearest MRT (metro) station as the explanatory variable. You’ll use code to make every commuter’s dream come true: shortening the distance to the metro station by taking the square root. Take that, geography!

taiwan_real_estate is available. ### Instructions - Look at the plot. - Add a new column to taiwan_real_estate called sqrt_dist_to_mrt_m that contains the square root of dist_to_mrt_m. - Create the same scatter plot as the first one, but use the new transformed variable on the x-axis instead. - Look at the new plot. Notice how the numbers on the x-axis have changed. This is a different line to what was shown before. Do the points track the line more closely?

# Create sqrt_dist_to_mrt_m

taiwan_real_estate["sqrt_dist_to_mrt_m"] = np.sqrt(taiwan_real_estate["dist_to_mrt_m"])

plt.figure()

# Plot using the transformed variable

sns.regplot(x="sqrt_dist_to_mrt_m", y = 'price_twd_msq', data = taiwan_real_estate)

plt.show()

# Create sqrt_dist_to_mrt_m

taiwan_real_estate["sqrt_dist_to_mrt_m"] = np.sqrt(taiwan_real_estate["dist_to_mrt_m"])

# Run a linear regression of price_twd_msq vs. square root of dist_to_mrt_m using taiwan_real_estate

mdl_price_vs_dist = ols("price_twd_msq~sqrt_dist_to_mrt_m", data=taiwan_real_estate).fit()

# Print the parameters

mdl_price_vs_dist.paramsIntercept 16.709799

sqrt_dist_to_mrt_m -0.182843

dtype: float64# Create sqrt_dist_to_mrt_m

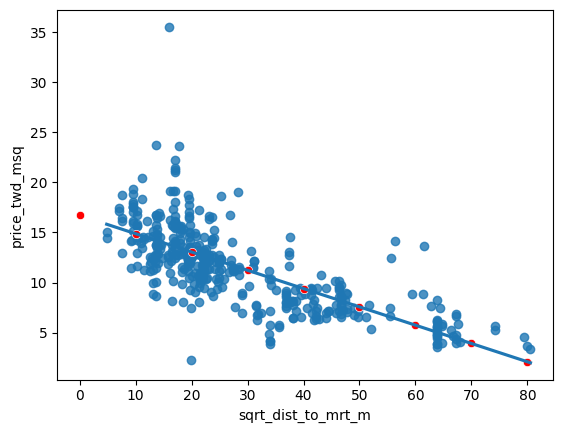

taiwan_real_estate["sqrt_dist_to_mrt_m"] = np.sqrt(taiwan_real_estate["dist_to_mrt_m"])

# Run a linear regression of price_twd_msq vs. sqrt_dist_to_mrt_m

mdl_price_vs_dist = ols("price_twd_msq ~ sqrt_dist_to_mrt_m", data=taiwan_real_estate).fit()

explanatory_data = pd.DataFrame({"sqrt_dist_to_mrt_m": np.sqrt(np.arange(0, 81, 10) ** 2),

"dist_to_mrt_m": np.arange(0, 81, 10) ** 2})

# Create prediction_data by adding a column of predictions to explantory_data

prediction_data = explanatory_data.assign(

price_twd_msq = mdl_price_vs_dist.predict(explanatory_data)

)

# Print the result

print(prediction_data) sqrt_dist_to_mrt_m dist_to_mrt_m price_twd_msq

0 0.0 0 16.709799

1 10.0 100 14.881370

2 20.0 400 13.052942

3 30.0 900 11.224513

4 40.0 1600 9.396085

5 50.0 2500 7.567656

6 60.0 3600 5.739227

7 70.0 4900 3.910799

8 80.0 6400 2.082370# Create sqrt_dist_to_mrt_m

taiwan_real_estate["sqrt_dist_to_mrt_m"] = np.sqrt(taiwan_real_estate["dist_to_mrt_m"])

# Run a linear regression of price_twd_msq vs. sqrt_dist_to_mrt_m

mdl_price_vs_dist = ols("price_twd_msq ~ sqrt_dist_to_mrt_m", data=taiwan_real_estate).fit()

# Use this explanatory data

explanatory_data = pd.DataFrame({"sqrt_dist_to_mrt_m": np.sqrt(np.arange(0, 81, 10) ** 2),

"dist_to_mrt_m": np.arange(0, 81, 10) ** 2})

# Use mdl_price_vs_dist to predict explanatory_data

prediction_data = explanatory_data.assign(

price_twd_msq = mdl_price_vs_dist.predict(explanatory_data)

)

fig = plt.figure()

sns.regplot(x="sqrt_dist_to_mrt_m", y="price_twd_msq", data=taiwan_real_estate, ci=None)

# Add a layer of your prediction points

sns.scatterplot(data=prediction_data, x="sqrt_dist_to_mrt_m", y="price_twd_msq", color="red")

plt.show()

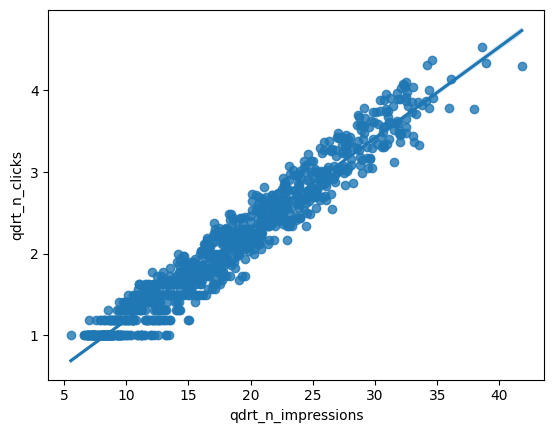

Transforming the response variable too

The response variable can be transformed too, but this means you need an extra step at the end to undo that transformation. That is, you “back transform” the predictions.

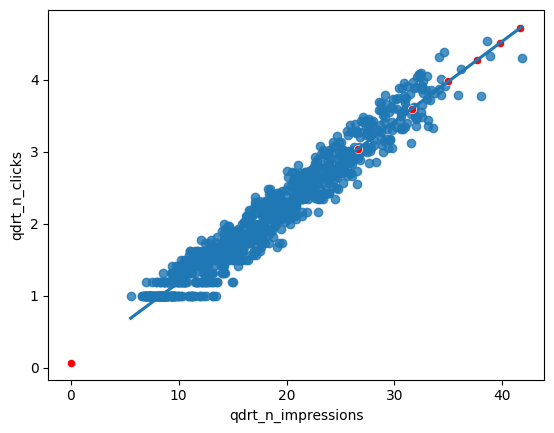

In the video, you saw the first step of the digital advertising workflow: spending money to buy ads, and counting how many people see them (the “impressions”). The next step is determining how many people click on the advert after seeing it.

ad_conversion is available as a pandas DataFrame. ### Instructions - Look at the plot. - Create a qdrt_n_impressions column using n_impressions raised to the power of 0.25. - Create a qdrt_n_clicks column using n_clicks raised to the power of 0.25. - Create a regression plot using the transformed variables. Do the points track the line more closely?

ad_conversion=conversion

# Create qdrt_n_impressions and qdrt_n_clicks

ad_conversion["qdrt_n_impressions"] = ad_conversion["n_impressions"]**0.25

ad_conversion["qdrt_n_clicks"] = ad_conversion["n_clicks"]**0.25

plt.figure()

# Plot using the transformed variables

sns.regplot(data=ad_conversion,x="qdrt_n_impressions",y="qdrt_n_clicks")

plt.show()

ad_conversion["qdrt_n_impressions"] = ad_conversion["n_impressions"] ** 0.25

ad_conversion["qdrt_n_clicks"] = ad_conversion["n_clicks"] ** 0.25

# Run a linear regression of your transformed variables

mdl_click_vs_impression = ols("qdrt_n_clicks ~ qdrt_n_impressions", data=ad_conversion).fit()ad_conversion["qdrt_n_impressions"] = ad_conversion["n_impressions"] ** 0.25

ad_conversion["qdrt_n_clicks"] = ad_conversion["n_clicks"] ** 0.25

mdl_click_vs_impression = ols("qdrt_n_clicks ~ qdrt_n_impressions", data=ad_conversion, ci=None).fit()

explanatory_data = pd.DataFrame({"qdrt_n_impressions": np.arange(0, 3e6+1, 5e5) ** .25,

"n_impressions": np.arange(0, 3e6+1, 5e5)})

# Complete prediction_data

prediction_data = explanatory_data.assign(

qdrt_n_clicks = mdl_click_vs_impression.predict(explanatory_data)

)

# Print the result

print(prediction_data) qdrt_n_impressions n_impressions qdrt_n_clicks

0 0.000000 0.0 0.071748

1 26.591479 500000.0 3.037576

2 31.622777 1000000.0 3.598732

3 34.996355 1500000.0 3.974998

4 37.606031 2000000.0 4.266063

5 39.763536 2500000.0 4.506696

6 41.617915 3000000.0 4.713520

/usr/local/lib/python3.8/dist-packages/statsmodels/base/model.py:130: ValueWarning:

unknown kwargs ['ci']Back transformation

In the previous exercise, you transformed the response variable, ran a regression, and made predictions. But you’re not done yet! In order to correctly interpret and visualize your predictions, you’ll need to do a back-transformation.

prediction_data, which you created in the previous exercise, is available. ### Instructions - Back transform the response variable in prediction_data by raising qdrt_n_clicks to the power 4 to get n_clicks. - Edit the plot to add a layer of points from prediction_data, colored “red”.

# Back transform qdrt_n_clicks

prediction_data["n_clicks"] = prediction_data["qdrt_n_clicks"]**4

print(prediction_data) qdrt_n_impressions n_impressions qdrt_n_clicks n_clicks

0 0.000000 0.0 0.071748 0.000026

1 26.591479 500000.0 3.037576 85.135121

2 31.622777 1000000.0 3.598732 167.725102

3 34.996355 1500000.0 3.974998 249.659131

4 37.606031 2000000.0 4.266063 331.214159

5 39.763536 2500000.0 4.506696 412.508546

6 41.617915 3000000.0 4.713520 493.607180# Back transform qdrt_n_clicks

prediction_data["n_clicks"] = prediction_data["qdrt_n_clicks"] ** 4

# Plot the transformed variables

fig = plt.figure()

sns.regplot(x="qdrt_n_impressions", y="qdrt_n_clicks", data=ad_conversion, ci=None)

# Add a layer of your prediction points

sns.scatterplot(data = prediction_data, y="qdrt_n_clicks", x="qdrt_n_impressions", color="red")

plt.show()

Chapter 3 : Assessing model fit

In this chapter, you’ll learn how to ask questions of your model to assess fit. You’ll learn how to quantify how well a linear regression model fits, diagnose model problems using visualizations, and understand each observation’s leverage and influence to create the model.

Coefficient of determination

The coefficient of determination is a measure of how well the linear regression line fits the observed values. For simple linear regression, it is equal to the square of the correlation between the explanatory and response variables.

Here, you’ll take another look at the second stage of the advertising pipeline: modeling the click response to impressions. Two models are available: mdl_click_vs_impression_orig models n_clicks versus n_impressions. mdl_click_vs_impression_trans is the transformed model you saw in Chapter 2. It models n_clicks to the power of 0.25 versus n_impressions to the power of 0.25. ### Instructions - Print the summary of mdl_click_vs_impression_orig. - Do the same for mdl_click_vs_impression_trans. - Print the coefficient of determination for mdl_click_vs_impression_orig. - Do the same for mdl_click_vs_impression_trans.

# Print a summary of mdl_click_vs_impression_orig

print(mdl_click_vs_impression_orig.summary())

# Print a summary of mdl_click_vs_impression_trans

print(mdl_click_vs_impression_trans.summary())

# Print the coeff of determination for mdl_click_vs_impression_orig

print(mdl_click_vs_impression_orig.rsquared)

# Print the coeff of determination for mdl_click_vs_impression_trans

print(mdl_click_vs_impression_trans.rsquared)Residual standard error

Residual standard error (RSE) is a measure of the typical size of the residuals. Equivalently, it’s a measure of how wrong you can expect predictions to be. Smaller numbers are better, with zero being a perfect fit to the data.

Again, you’ll look at the models from the advertising pipeline, mdl_click_vs_impression_orig and mdl_click_vs_impression_trans. ### Instructions - Calculate the MSE of mdl_click_vs_impression_orig, assigning to mse_orig. - Using mse_orig, calculate and print the RSE of mdl_click_vs_impression_orig. - Do the same for mdl_click_vs_impression_trans.

# Calculate mse_orig for mdl_click_vs_impression_orig

mse_orig = mdl_click_vs_impression_orig.mse_resid

# Calculate rse_orig for mdl_click_vs_impression_orig and print it

rse_orig = np.sqrt(mse_orig)

print("RSE of original model: ", rse_orig)

# Calculate mse_trans for mdl_click_vs_impression_trans

mse_trans = mdl_click_vs_impression_trans.mse_resid

# Calculate rse_trans for mdl_click_vs_impression_trans and print it

rse_trans = np.sqrt(mse_trans)

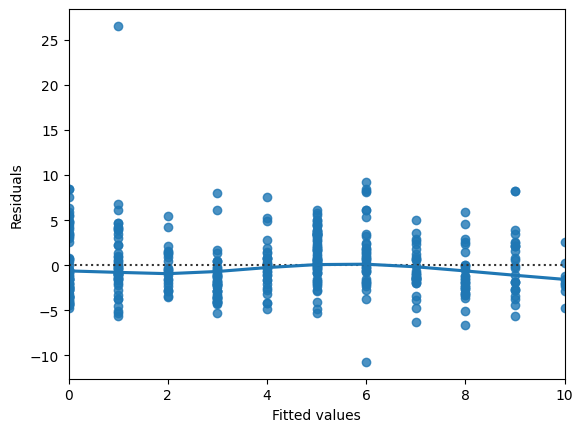

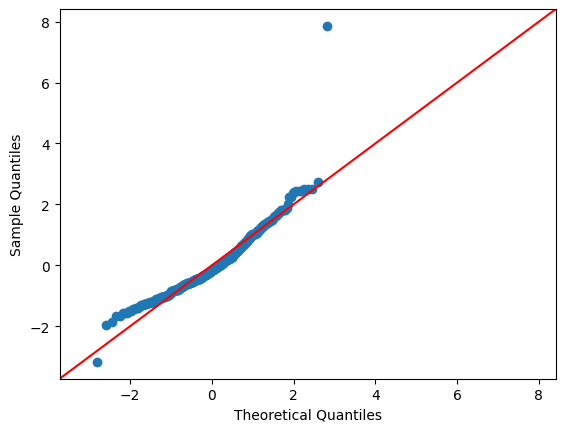

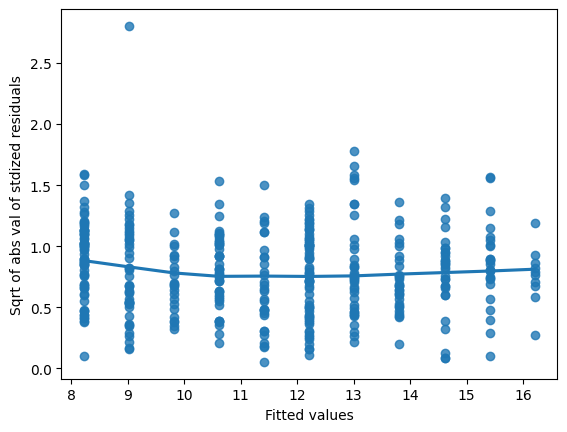

print("RSE of transformed model: ", rse_trans)Drawing diagnostic plots

It’s time for you to draw these diagnostic plots yourself using the Taiwan real estate dataset and the model of house prices versus number of convenience stores.

taiwan_real_estate is available as a pandas DataFrame and mdl_price_vs_conv is available. ### Instructions - Create the residuals versus fitted values plot. Add a lowess argument to visualize the trend of the residuals. - Import qqplot() from statsmodels.api. - Create the Q-Q plot of the residuals. - Create the scale-location plot.

# Plot the residuals vs. fitted values

sns.residplot(x='n_convenience', y='price_twd_msq', data=taiwan_real_estate, lowess=True)

plt.xlabel("Fitted values")

plt.ylabel("Residuals")

# Show the plot

plt.show()

# Import qqplot

from statsmodels.api import qqplot

# Create the Q-Q plot of the residuals

qqplot(data=mdl_price_vs_conv.resid, fit=True, line="45")

# Show the plot

plt.show()

# Preprocessing steps

model_norm_residuals = mdl_price_vs_conv.get_influence().resid_studentized_internal

model_norm_residuals_abs_sqrt = np.sqrt(np.abs(model_norm_residuals))

# Create the scale-location plot

sns.regplot(x=mdl_price_vs_conv.fittedvalues, y=model_norm_residuals_abs_sqrt, ci=None, lowess=True)

plt.xlabel("Fitted values")

plt.ylabel("Sqrt of abs val of stdized residuals")

# Show the plot

plt.show()

Leverage

Leverage measures how unusual or extreme the explanatory variables are for each observation. Very roughly, high leverage means that the explanatory variable has values that are different from other points in the dataset. In the case of simple linear regression, where there is only one explanatory value, this typically means values with a very high or very low explanatory value.

Here, you’ll look at highly leveraged values in the model of house price versus the square root of distance from the nearest MRT station in the Taiwan real estate dataset.

Guess which observations you think will have a high leverage, then move the slider to find out.

Which statement is true? ### Instructions - Observations with a large distance to the nearest MRT station have the highest leverage, because these points are furthest away from the linear regression trend line. - Observations with a large distance to the nearest MRT station have the highest leverage, because leverage is proportional to the explanatory variable. - Observations with a large distance to the nearest MRT station have the highest leverage, because most of the observations have a short distance, so long distances are more extreme. - Observations with a high price have the highest leverage, because most of the observations have a low price, so high prices are most extreme.

Influence

Influence measures how much a model would change if each observation was left out of the model calculations, one at a time. That is, it measures how different the prediction line would look if you would run a linear regression on all data points except that point, compared to running a linear regression on the whole dataset.

The standard metric for influence is Cook’s distance, which calculates influence based on the residual size and the leverage of the point.

You can see the same model as last time: house price versus the square root of distance from the nearest MRT station in the Taiwan real estate dataset.

Guess which observations you think will have a high influence, then move the slider to find out.

Which statement is true? ### Instructions - Observations far away from the trend line have high influence, because they have large residuals and are far away from other observations. - Observations with high prices have high influence, because influence is proportional to the response variable. - Observations far away from the trend line have high influence, because the slope of the trend is negative. - Observations far away from the trend line have high influence, because that increases the leverage of those points.

Extracting leverage and influence

In the last few exercises, you explored which observations had the highest leverage and influence. Now you’ll extract those values from the model.

mdl_price_vs_dist and taiwan_real_estate are available. ### Instructions - Get the summary frame from mdl_price_vs_dist and save as summary_info. - Add the hat_diag column of summary_info to taiwan_real_estate as the leverage column. - Sort taiwan_real_estate by leverage in descending order and print the head. - Add the cooks_d column from summary_info to taiwan_real_estate as the cooks_dist column. - Sort taiwan_real_estate by cooks_dist in descending order and print the head.

# Create summary_info

summary_info = mdl_price_vs_dist.get_influence().summary_frame()

# Add the hat_diag column to taiwan_real_estate, name it leverage

taiwan_real_estate["leverage"] = summary_info['hat_diag']

# Sort taiwan_real_estate by leverage in descending order and print the head

print(taiwan_real_estate.sort_values("leverage", ascending=False).head())

# Create summary_info

summary_info = mdl_price_vs_dist.get_influence().summary_frame()

# Add the hat_diag column to taiwan_real_estate, name it leverage

taiwan_real_estate["leverage"] = summary_info["hat_diag"]

# Add the cooks_d column to taiwan_real_estate, name it cooks_dist

taiwan_real_estate["cooks_dist"]=summary_info['cooks_d']

# Sort taiwan_real_estate by cooks_dist in descending order and print the head.

print(taiwan_real_estate.sort_values("cooks_dist",ascending=False).head()) dist_to_mrt_m n_convenience ... sqrt_dist_to_mrt_m leverage

347 6488.021 1 ... 80.548253 0.026665

116 6396.283 1 ... 79.976765 0.026135

249 6306.153 1 ... 79.411290 0.025617

255 5512.038 1 ... 74.243101 0.021142

8 5512.038 1 ... 74.243101 0.021142

[5 rows x 6 columns]

dist_to_mrt_m n_convenience ... leverage cooks_dist

270 252.5822 1 ... 0.003849 0.115549

148 3780.5900 0 ... 0.012147 0.052440

228 3171.3290 0 ... 0.009332 0.035384

220 186.5101 9 ... 0.004401 0.025123

113 393.2606 6 ... 0.003095 0.022813

[5 rows x 7 columns]Chapter 4: Simple Logistic Regression Modeling

Learn to fit logistic regression models. Using real-world data, you’ll predict the likelihood of a customer closing their bank account as probabilities of success and odds ratios, and quantify model performance using confusion matrices.

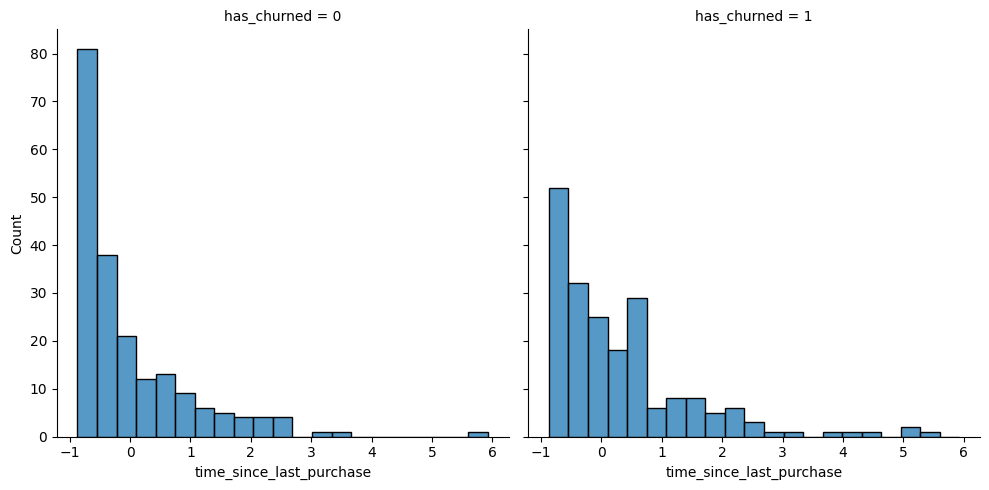

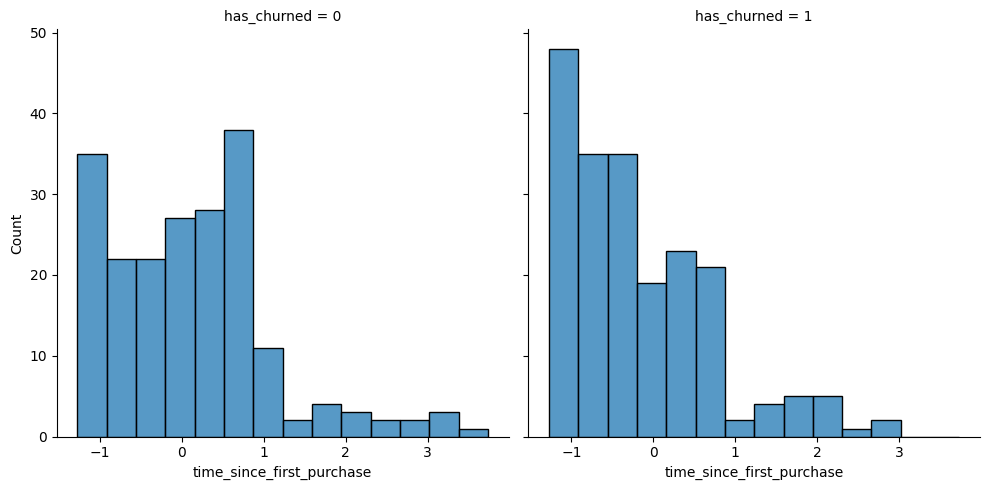

Exploring the explanatory variables

When the response variable is logical, all the points lie on the and

lines, making it difficult to see what is happening. In the video, until you saw the trend line, it wasn’t clear how the explanatory variable was distributed on each line. This can be solved with a histogram of the explanatory variable, grouped by the response.

You will use these histograms to get to know the financial services churn dataset seen in the video.

churn is available as a pandas DataFrame. ### Instructions - In a sns.displot() call on the churn data, plot time_since_last_purchase as two histograms, split for each has_churned value. - Redraw the histograms using the time_since_first_purchase column, split for each has_churned value.

# Create the histograms of time_since_last_purchase split by has_churned

sns.displot(data=churn,x='time_since_last_purchase', col='has_churned')

plt.show()

# Redraw the plot with time_since_first_purchase

sns.displot(data=churn,x='time_since_first_purchase',col='has_churned')

plt.show()

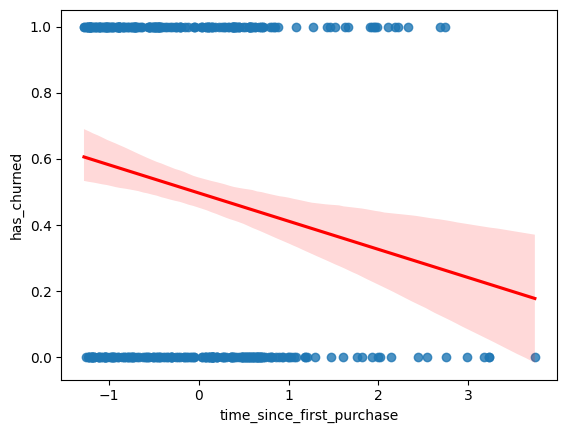

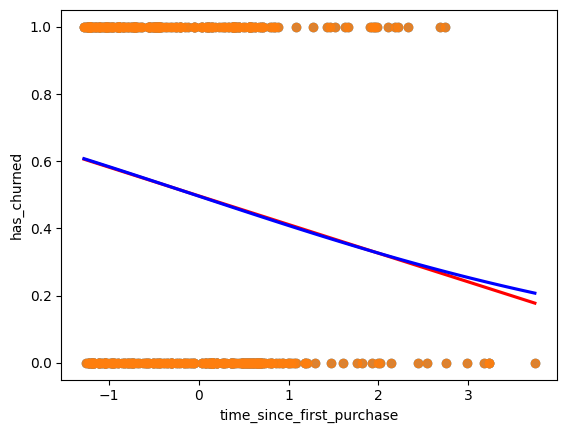

Visualizing linear and logistic models

As with linear regressions, regplot() will draw model predictions for a logistic regression without you having to worry about the modeling code yourself. To see how the predictions differ for linear and logistic regressions, try drawing both trend lines side by side. Spoiler: you should see a linear (straight line) trend from the linear model, and a logistic (S-shaped) trend from the logistic model.

churn is available. ### Instructions - Using churn, plot has_churned versus time_since_first_purchase as a scatter plot with a red linear regression trend line (without a standard error ribbon). - Using churn, plot has_churned versus time_since_first_purchase as a scatter plot with a blue logistic regression trend line (without a standard error ribbon).

# Draw a linear regression trend line and a scatter plot of time_since_first_purchase vs. has_churned

sns.regplot(data=churn,x='time_since_first_purchase', y='has_churned',

line_kws={"color": "red"})

plt.show()

# Draw a linear regression trend line and a scatter plot of time_since_first_purchase vs. has_churned

sns.regplot(x="time_since_first_purchase",

y="has_churned",

data=churn,

ci=None,

line_kws={"color": "red"})

# Draw a logistic regression trend line and a scatter plot of time_since_first_purchase vs. has_churned

sns.regplot(x="time_since_first_purchase",

y="has_churned",

data=churn,

ci=None,

line_kws={"color": "blue"},

logistic=True)

plt.show()

Logistic regression with logit()

Logistic regression requires another function from statsmodels.formula.api: logit(). It takes the same arguments as ols(): a formula and data argument. You then use .fit() to fit the model to the data.

Here, you’ll model how the length of relationship with a customer affects churn.

churn is available. ### Instructions - Import the logit() function from statsmodels.formula.api. - Fit a logistic regression of has_churned versus time_since_first_purchase using the churn dataset. Assign to mdl_churn_vs_relationship. - Print the parameters of the fitted model.

# Import logit

from statsmodels.formula.api import logit

# Fit a logistic regression of churn vs. length of relationship using the churn dataset

mdl_churn_vs_relationship = logit("has_churned ~ time_since_first_purchase", data=churn).fit()

# Print the parameters of the fitted model

print(mdl_churn_vs_relationship.params)Optimization terminated successfully.

Current function value: 0.679663

Iterations 4

Intercept -0.015185

time_since_first_purchase -0.354795

dtype: float64Probabilities

There are four main ways of expressing the prediction from a logistic regression model – we’ll look at each of them over the next four exercises. Firstly, since the response variable is either “yes” or “no”, you can make a prediction of the probability of a “yes”. Here, you’ll calculate and visualize these probabilities.

Two variables are available:

mdl_churn_vs_relationship is the fitted logistic regression model of has_churned versus time_since_first_purchase.

explanatory_data is a DataFrame of explanatory values.Instructions

- Create a DataFrame, prediction_data, by assigning a column has_churned to explanatory_data.

- In the has_churned column, store the predictions of the probability of churning: use the model, mdl_churn_vs_relationship, and the explanatory data, explanatory_data.

- Print the first five lines of the prediction DataFrame.

- Create a scatter plot with a logistic trend line of has_churned versus time_since_first_purchase.

- Overlay the plot with the points from prediction_data, colored red.

# Create prediction_data

prediction_data = explanatory_data.assign(

has_churned = mdl_churn_vs_relationship.predict(explanatory_data)

)

# Print the head

print(prediction_data.head())# Create prediction_data

prediction_data = explanatory_data.assign(

has_churned = mdl_churn_vs_relationship.predict(explanatory_data)

)

fig = plt.figure()

# Create a scatter plot with logistic trend line

sns.scatterplot(x="time_since_first_purchase", y="has_churned", data=prediction_data, color="red")

# Overlay with prediction_data, colored red

sns.regplot(x="time_since_first_purchase", y="has_churned",data=churn, ci=None, logistic=True)

plt.show()Most likely outcome

When explaining your results to a non-technical audience, you may wish to side-step talking about probabilities and simply explain the most likely outcome. That is, rather than saying there is a 60% chance of a customer churning, you say that the most likely outcome is that the customer will churn. The trade-off here is easier interpretation at the cost of nuance.

mdl_churn_vs_relationship, explanatory_data, and prediction_data are available from the previous exercise. ### Instructions - Update prediction_data to add a column of the most likely churn outcome, most_likely_outcome. - Print the first five lines of prediction_data. - The code for creating a scatter plot with logistic trend line has been added from a previous exercise. - Overlay the plot with prediction_data with red data points, with most_likely_outcome on the y-axis.

# Update prediction data by adding most_likely_outcome

prediction_data["most_likely_outcome"] = np.round(prediction_data["has_churned"])

# Print the head

print(prediction_data.head())# Update prediction data by adding most_likely_outcome

prediction_data["most_likely_outcome"] = np.round(prediction_data["has_churned"])

fig = plt.figure()

# Create a scatter plot with logistic trend line (from previous exercise)

sns.regplot(x="time_since_first_purchase",

y="has_churned",

data=churn,

ci=None,

logistic=True)

# Overlay with prediction_data, colored red

sns.scatterplot(x="time_since_first_purchase", y="most_likely_outcome", data=prediction_data, color="red")

plt.show()Odds ratio

Odds ratios compare the probability of something happening with the probability of it not happening. This is sometimes easier to reason about than probabilities, particularly when you want to make decisions about choices. For example, if a customer has a 20% chance of churning, it may be more intuitive to say “the chance of them not churning is four times higher than the chance of them churning”.

mdl_churn_vs_relationship, explanatory_data, and prediction_data are available from the previous exercise. ### Instructions - Update prediction_data to add a column, odds_ratio, of the odds ratios. - Print the first five lines of prediction_data. - Using prediction_data, draw a line plot of odds_ratio versus time_since_first_purchase. - Some code for preparing the final plot has already been added.

# Update prediction data with odds_ratio

prediction_data["odds_ratio"] = prediction_data["has_churned"] / (1 - prediction_data["has_churned"])

# Print the head

print(prediction_data.head())# Update prediction data with odds_ratio

prediction_data["odds_ratio"] = prediction_data["has_churned"] / (1 - prediction_data["has_churned"])

fig = plt.figure()

# Create a line plot of odds_ratio vs time_since_first_purchase

sns.lineplot(data=prediction_data,x="time_since_first_purchase",y='odds_ratio')

# Add a dotted horizontal line at odds_ratio = 1

plt.axhline(y=1, linestyle="dotted")

plt.show()Log odds ratio

One downside to probabilities and odds ratios for logistic regression predictions is that the prediction lines for each are curved. This makes it harder to reason about what happens to the prediction when you make a change to the explanatory variable. The logarithm of the odds ratio (the “log odds ratio” or “logit”) does have a linear relationship between predicted response and explanatory variable. That means that as the explanatory variable changes, you don’t see dramatic changes in the response metric - only linear changes.

Since the actual values of log odds ratio are less intuitive than (linear) odds ratio, for visualization purposes it’s usually better to plot the odds ratio and apply a log transformation to the y-axis scale.

mdl_churn_vs_relationship, explanatory_data, and prediction_data are available from the previous exercise. ### Instructions - Update prediction_data to add a log_odds_ratio column derived from odds_ratio. - Print the first five lines of prediction_data. - Update the code for the line plot to plot log_odds_ratio versus time_since_first_purchase.

# Update prediction data with log_odds_ratio

prediction_data["log_odds_ratio"] = np.log(prediction_data["odds_ratio"])

fig = plt.figure()

# Update the line plot: log_odds_ratio vs. time_since_first_purchase

sns.lineplot(x="time_since_first_purchase",

y="log_odds_ratio",

data=prediction_data)

# Add a dotted horizontal line at log_odds_ratio = 0

plt.axhline(y=0, linestyle="dotted")

plt.show()Calculating the confusion matrix

A confusion matrix (occasionally called a confusion table) is the basis of all performance metrics for models with a categorical response (such as a logistic regression). It contains the counts of each actual response-predicted response pair. In this case, where there are two possible responses (churn or not churn), there are four overall outcomes.

True positive: The customer churned and the model predicted they would.

False positive: The customer didn't churn, but the model predicted they would.

True negative: The customer didn't churn and the model predicted they wouldn't.

False negative: The customer churned, but the model predicted they wouldn't.churn and mdl_churn_vs_relationship are available. ### Instructions - Get the actual responses by subsetting the has_churned column of the dataset. Assign to actual_response. - Get the “most likely” predicted responses from the model. Assign to predicted_response. - Create a DataFrame from actual_response and predicted_response. Assign to outcomes. - Print outcomes as a table of counts, representing the confusion matrix. This has been done for you.

# Get the actual responses

actual_response = churn['has_churned']

# Get the predicted responses

predicted_response = np.round(mdl_churn_vs_relationship.predict())

# Create outcomes as a DataFrame of both Series

outcomes = pd.DataFrame({'actual_response':actual_response,

'predicted_response':predicted_response})

# Print the outcomes

print(outcomes.value_counts(sort = False))Drawing a mosaic plot of the confusion matrix

While calculating the performance matrix might be fun, it would become tedious if you needed multiple confusion matrices of different models. Luckily, the .pred_table() method can calculate the confusion matrix for you.

Additionally, you can use the output from the .pred_table() method to visualize the confusion matrix, using the mosaic() function.

churn and mdl_churn_vs_relationship are available. ### Instructions - Import the mosaic() function from statsmodels.graphics.mosaicplot. - Create conf_matrix using the .pred_table() method and print it. - Draw a mosaic plot of the confusion matrix.

# Import mosaic from statsmodels.graphics.mosaicplot

from statsmodels.graphics.mosaicplot import mosaic

# Calculate the confusion matrix conf_matrix

conf_matrix = mdl_churn_vs_relationship.pred_table()

# Print it

print(conf_matrix)

# Draw a mosaic plot of conf_matrix

mosaic(conf_matrix)

plt.show()Measuring logistic model performance

As you know by now, several metrics exist for measuring the performance of a logistic regression model. In this last exercise, you’ll manually calculate accuracy, sensitivity, and specificity. Recall the following definitions:

Accuracy is the proportion of predictions that are correct. Sensitivity is the proportion of true observations that are correctly predicted by the model as being true. Specificity is the proportion of false observations that are correctly predicted by the model as being false.

churn, mdl_churn_vs_relationship, and conf_matrix are available. Instructions 100 XP

Extract the number of true positives (TP), true negatives (TN), false positives (FP), and false negatives (FN) from conf_matrix.

Calculate the accuracy of the model.

Calculate the sensitivity of the model.

Calculate the specificity of the model.# Extract TN, TP, FN and FP from conf_matrix

TN = conf_matrix[0,0]

TP = conf_matrix[1,1]

FN = conf_matrix[1,0]

FP = conf_matrix[0,1]

# Calculate and print the accuracy

accuracy = (TN+TP)/(TN+FN+FP+TP)

print("accuracy: ", accuracy)

# Calculate and print the sensitivity

sensitivity = TP/(TP+FN)

print("sensitivity: ", sensitivity)

# Calculate and print the specificity

specificity = TN/(TN+FP)

print("specificity: ", specificity)